Finance & Business

Nvidia's Record-Breaking Earnings Validate AI Revolution as Investor Confidence Soars

The artificial intelligence revolution just received its strongest validation yet. Nvidia, the chipmaker powering the global AI transformation, delivered quarterly earnings that shattered expectations and sent a clear message to skeptics: the AI boom isn't slowing down—it's accelerating.

The semiconductor giant reported $57 billion in sales for the October quarter, representing a 62% year-over-year surge CNN, while profits climbed 65% to $31.9 billion CNN. These figures exceeded analyst projections and demonstrated that enterprise demand for AI infrastructure remains insatiable despite mounting concerns about overinvestment.

Blackwell Chips Drive Unprecedented Demand

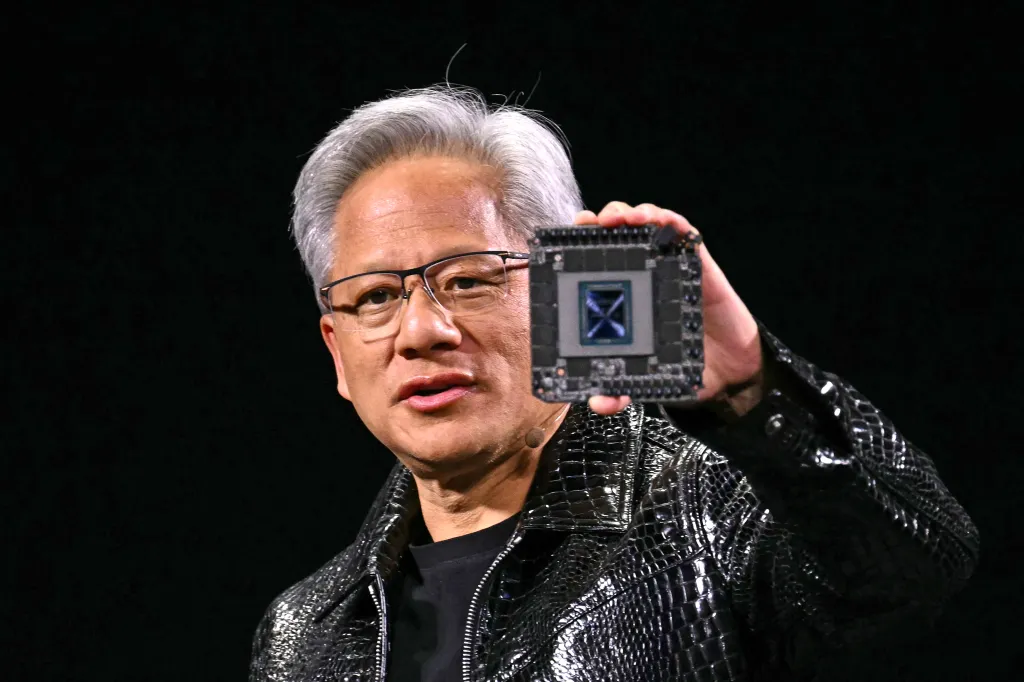

CEO Jensen Huang characterized the momentum succinctly: "Blackwell sales are off the charts, and cloud GPUs are sold out" CNN. This enthusiasm reflects ground-level reality as hyperscalers and enterprises scramble to secure computing capacity for training increasingly sophisticated AI models.

At a recent Washington conference, Huang revealed that Nvidia has accumulated $500 billion in chip orders spanning 2025 and 2026 NBC News, providing extraordinary visibility into future revenue streams. This backlog effectively insulates the company from near-term demand fluctuations while validating the sustainability of current AI infrastructure investments.

The company's forward guidance reinforces this trajectory. Nvidia projected approximately $65 billion in fourth-quarter sales CNN, signaling that mega-cap technology firms show no signs of reducing their AI spending commitments.

Addressing the AI Bubble Narrative

Market observers have increasingly questioned whether AI investments represent a speculative bubble detached from genuine economic returns. On an investor call, Huang directly confronted these concerns: "There's been a lot of talk about an AI bubble. From our vantage point, we see something very different" NBC News.

His confidence stems from observable market dynamics. Major technology platforms—including Meta, Microsoft, Amazon, and Google—have all confirmed plans to escalate AI infrastructure expenditures in their recent earnings disclosures. These aren't speculative bets; they're strategic imperatives driven by competitive pressures and genuine customer demand for AI-powered capabilities.

Financial analysts largely echo this assessment. Dan Ives from Wedbush Securities characterized the results as "a golden quarter for Nvidia with demand massive and well above Street whisper numbers" NBC News, indicating that even elevated expectations underestimated actual performance.

Supply Constraints Persist Despite Production Ramps

Interestingly, Nvidia's challenge isn't finding customers—it's manufacturing enough chips to satisfy demand. The company continues navigating supply constraints, particularly for next-generation Blackwell processors that represent the cutting edge of AI acceleration technology.

This supply-demand imbalance provides Nvidia with exceptional pricing power and positions the company to maintain elevated profit margins throughout 2025. For investors, these dynamics translate into predictable revenue streams and sustainable competitive advantages.

Broader Economic Implications

Nvidia's success carries implications extending far beyond semiconductor markets. The company's performance effectively backstops broader equity market gains, particularly within technology sectors where AI represents the dominant investment theme.

Goldman Sachs researchers acknowledged this connection, noting "We think the investment boom has room to run" while emphasizing that economic resilience should support continued stock market returns NBC News. Nvidia's earnings validate this optimistic outlook by demonstrating that AI infrastructure spending generates measurable business outcomes rather than speculative enthusiasm.

The earnings also address concerns about circular financial arrangements between AI companies and chip manufacturers. While these relationships have drawn scrutiny, the sustained demand from diverse enterprise sectors suggests that AI monetization extends well beyond closed-loop investments among technology giants.

Looking Forward: The AI Infrastructure Buildout Continues

Nvidia's exceptional quarter reinforces a fundamental reality: we remain in the early phases of a multi-year AI infrastructure deployment cycle. Enterprises across industries are only beginning to integrate AI capabilities into their core operations, suggesting that current demand levels represent a baseline rather than a peak.

The company's technology roadmap extends beyond data center chips into emerging categories including edge computing, autonomous systems, and telecommunications infrastructure. This diversification strategy positions Nvidia to capture value across the entire AI ecosystem as deployment patterns mature.

For investors who questioned whether AI investments would deliver returns, Nvidia's latest results provide a definitive answer. The technology isn't approaching maturity—it's entering an accelerated growth phase supported by fundamental business transformations across the global economy.

As enterprises continue digitizing operations and consumers increasingly interact with AI-powered services, Nvidia stands positioned at the center of this transformation. The latest earnings don't merely reflect strong quarterly performance; they validate that artificial intelligence represents a genuine technological revolution rather than speculative excess.

Comments (0)

Please log in to comment

No comments yet. Be the first!